|

|

|

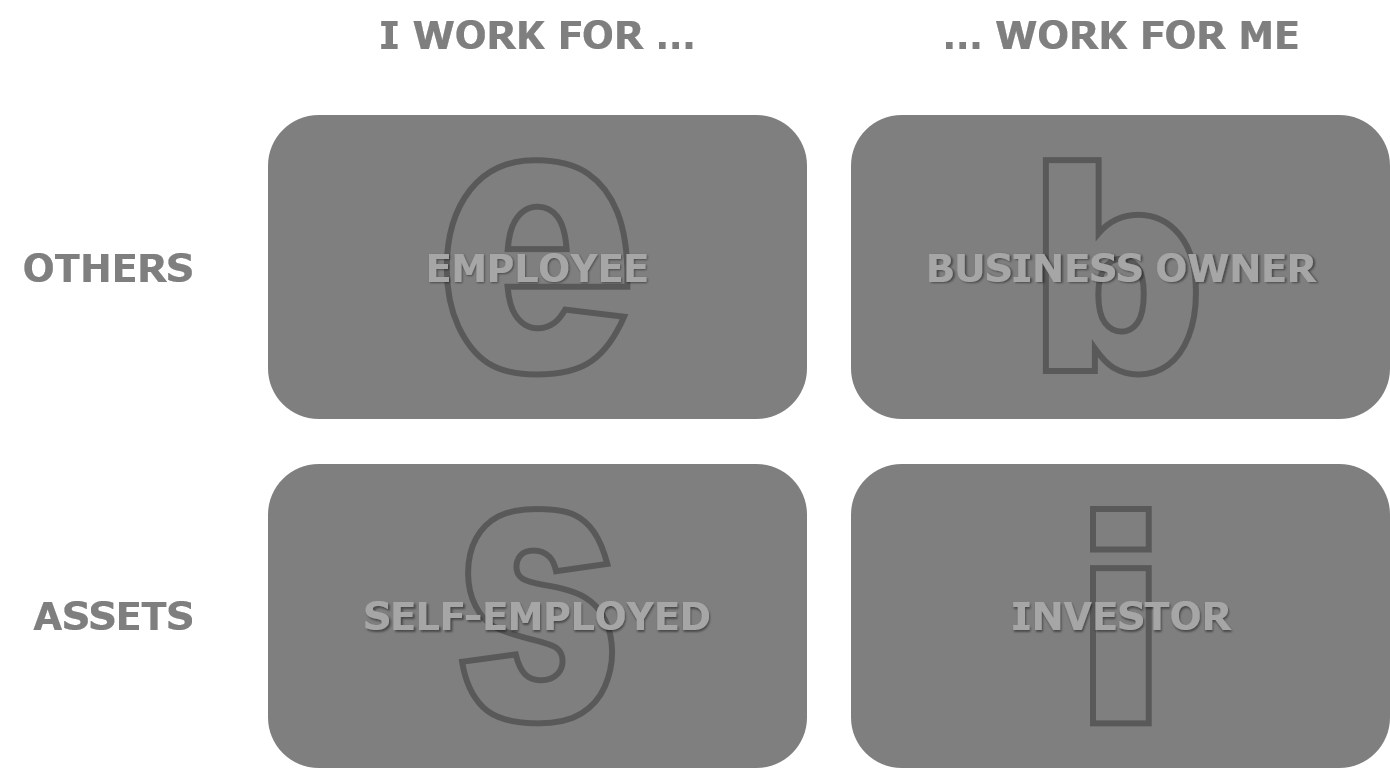

The ESBI Model of Earning Money |

Essentially, there are four different ways to earn money, as shown in the figure below. This ‘ESBI Model of Earning Money’ is based on the book “Cashflow Quadrant” (published in 1988) by Robert Toru Kiyosaki (1947).

The way to earn money differs per quadrant.

In the first quadrant (e), the earnings are relatively low, and so are the risks, like the risk of losing your job or not getting paid (in case your employer goes bankrupt). On the other hand, the earnings are relatively high in the fourth quadrant (i), but this is also true for the risks, as you could not only lose all your money, but even ending up with a debt is a possibility. The earnings in each quadrant are therefore more or less proportionate to the risks. In other words, financial management includes risk management.

Currently, about 95% of the people are in the left-hand-side quadrants (e and s), while 95% of the money is earned by the people in the right-hand-side quadrants (b and i). Therefore, to increase your earnings, becoming a business owner (b) or an investor (i) is the smart thing to do. If this is what you want, then contact me. With relatively low risks, I can help you earn considerably more as soon as possible. And no, it is most certainly not too good to be true; it is too good to let it slip by.

If the above statements trigger negative thoughts in your mind, I can understand this very well, as this happened to me as well when these opportunities were presented to me. Nevertheless, I dared to commence with it. Now looking back, I am very grateful that I grabbed this opportunity with both my hands when it came by. What do you do?

This article on the ESBI model, written on Saturday 7 September 2019, by Johan Oldenkamp, is also available in Dutch.

© Pateo.NL : This page was last updated on 2019/09/17.